Q1 ’25 Recap & Q2 Roadmap

- Minh Nguyen

- Apr 13, 2025

- 4 min read

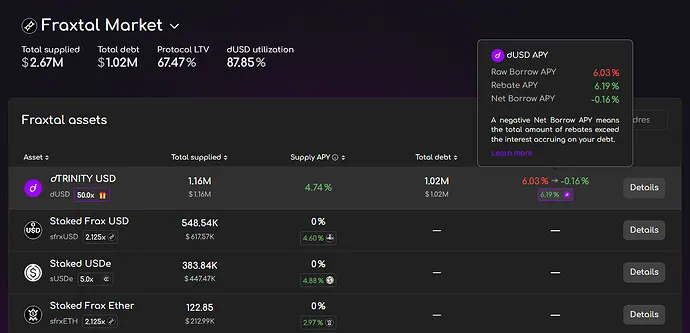

Since its debut in December 2024, dTRINITY has grown to over $4.5M TVL by the end of Q1 ’25, becoming the largest native dApp and lending protocol on Fraxtal. Our demand-centric stablecoin model — the first of its kind in DeFi — quickly gained adoption in the Fraxtal community, with strong product/market fit demonstrated through superior stablecoin rates and consistently high utilization.

What is dTRINITY?

dTRINITY is the world’s first subsidized stablecoin protocol — a new primitive designed to supercharge DeFi markets.

The protocol features dUSD, a decentralized stablecoin fully backed by an exogenous onchain reserve of price-stable, yield-bearing assets (e.g., DAI, sDAI, frxUSD, sfrxUSD). It is also the first demand-centric stablecoin that externalizes the underlying yield to its borrowers instead of holders/stakers.

dUSD’s reserve earnings are used to fund ongoing interest rebates for borrowers on dLEND, an Aave v3 fork. These rebates lower dUSD’s effective Borrow APR, boosting credit demand and utilization while raising lenders’ Supply APR. This, in turn, increases dUSD’s velocity on DEXs, generating more trading volume and fees for liquidity providers.

By paying users to borrow, dTRINITY is able to shift the demand curve upward, creating a higher supply-demand equilibrium that unlocks greater capital efficiency and yields for dUSD. This novel mechanism can also be applied to create subsidized crypto-pegged stablecoins (e.g., dETH), producing a similar effect to subsidized USD-pegged stablecoins.

dTRINITY is live now on Fraxtal L2 (app.dtrinity.org). Stay tuned for our upcoming expansion to Sonicthis quarter! 🚀

Timeline Recap

December 2024

Officially announced mainnet launch (link)

Enabled dLEND markets for sfrxUSD and sfrxETH

Released the dT Points program for lenders and LPs

Discovered dUSD Net Borrow APY is consistently lower than its Supply APY thanks to subsidies — an unseen phenomenon in DeFi (link)

Released the dTRINITY Holiday mixtape (link)

End-of-month TVL = $3.19M

January 2025

Obtained the first Curve gauge for a dUSD pool (link)

FXS emissions went live for dUSD pools on Curve (link)

Enabled dLEND markets for Frax Bonds (link)

Partnered with 512M for research content (link)

Leviathan News interview with Kory and David, dTRINITY’s lead contributors (link)

dUSD Net Borrow APY on dLEND reaches equilibrium vs. Aave (link)

End-of-month TVL = $4.53M

February

Hired an ex-Gauntlet and Binance Growth Lead (link)

512M released a research article about dUSD (link)

CRV and FXTL emissions went live for dUSD pools on Curve (link)

dUSD LP staking went live on Convex (link)

sUSDe looping surpasses 50% Net APY on dLEND (link)

Enabled dLEND markets for all top assets on Fraxtal (link)

Consistently outperformed stablecoin rates on Aave (link)

Attended Consensus HK and ETHDenver (link)

End-of-month TVL = $4.47M

March

A wild dMANATEE appeared (link)

512M released a research article about dLEND (link)

sfrxUSD becomes the top supplied collateral on dLEND (link)

Points from Ethena went live for dLEND markets (link)

dUSD Curve pools achieved the highest APYs on Fraxtal (link)

Continued outperforming stablecoin rates on Aave (link)

Consistently sustained high utilization despite the bear market (link)

Partnered with Alpha Growth to acquire new TVL

Began outreach to Sonic ecosystem partners

Started development on Sonic expansion

Successfully executed 1 SMO for dUSD (link)

End-of-month TVL = $4.77M

Q2-Q4 Roadmap

Q2

Expand dUSD, dLEND, and dT Points to Sonic (more details in FIP-430)

Partner with Frax, Rings, Beets, Origin, Silo, SwapX, and more on Sonic

Partner with Merklto distribute Sonic ecosystem incentives

Launch dTRINITY S (dS), the first subsidized LST on Sonic

Launch smart contract audit competition with $100K bounty

Update documentation

Q3

Complete smart contract audit competition

Launch Staked dUSD (sdUSD), a yield-bearing version of dUSD

Partner with CrossCurveto enable cross-chain bridging/swapping

Partner with Stake DAO to enable boosted Curve LP staking

Partner with tokenized yield markets (e.g., Pendle, Spectra, Napier)

Partner with more supply-centric stablecoin projects (e.g., Sky, Level)

Q4

Expand dUSD, dLEND, and dT Points to Ethereum

Launch dTRINITY ETH (dETH), the first subsidized LST on Ethereum

Launch Staked dETH (sdETH), a yield-bearing version of dETH

Launch dLOOP strategy vaults for subsidized yield looping

Partner with Turtle Club and Dewhales to grow strategic TVL

Token generation event (TGE) — dT Points convert to TRIN

Plus more…

📢 Join the dTRINITY community to get the latest updates!

Website | X (Twitter) | Documentation | Discord | Blog | Other links

Disclaimer: dTRINITY is not available to residents of Canada, Iran, North Korea, Russia, the USA, the UK, and other restricted regions.

The information contained herein should not be considered legal, business, financial, or tax advice. Past performance is not indicative of future results. Digital assets and DeFi protocols carry significant risks, including the potential for complete loss of funds. By using dTRINITY, you acknowledge and accept these inherent risks. View our full Disclaimer and Terms to learn more about the risks involved.